Introduction to Forex Charts

Forex charts are essential tools that every trader should familiarize themselves with, as they play a significant role in the decision-making process within the foreign exchange market. Understanding how to read and interpret these charts can greatly enhance a trader’s ability to forecast future price movements and make informed trading decisions. Whether one is a beginner or an experienced trader, mastering the nuances of forex charts can lead to improved trading outcomes and increased profitability.

Forex charts provide visual representations of currency pairs’ price movements over a specified timeframe. These charts are fundamental because they allow traders to identify trends, support and resistance levels, and various patterns that can signify potential trading opportunities. The primary types of forex charts available include line charts, bar charts, and candlestick charts, each providing unique information and insights. Line charts offer a straightforward depiction of price movements by connecting closing prices over time. In contrast, bar charts provide more detail by indicating opening, closing, high, and low prices for a given period. Candlestick charts, which are quite popular among traders, display price action through a combination of color, shape, and size, thus allowing for an intuitive understanding of market sentiment.

As traders analyze these charts, they gain valuable context regarding market behavior and can identify potential entry and exit points for their trades. Furthermore, the integration of technical indicators into these charts can augment analyses and support traders’ strategies. Ultimately, grasping the functionality and importance of forex charts is crucial for anyone looking to succeed in the forex market, and it sets the foundation for understanding more advanced trading concepts and methodologies.

Understanding the Different Types of Charts

Forex trading involves a thorough understanding of various types of charts, as they are essential tools for both novice and experienced traders. The three primary types of forex charts are line charts, bar charts, and candlestick charts, each serving unique functions and offering distinct benefits.

Line charts are the simplest and most straightforward type of chart. They display price movements over a specific period by connecting closing prices with a continuous line. This type of chart is particularly useful for identifying overall trends as it smoothens out price fluctuations, allowing traders to gain a clearer view of market direction. Line charts are best for those who prefer a minimalist approach to analyzing price movement without the distractions of too much detail.

Bar charts, on the other hand, provide a more detailed view of price action. Each bar represents the opening, high, low, and closing prices during a specific time frame. The vertical line showcases the price range, while the horizontal lines indicate the opening and closing prices. This type of chart is advantageous for traders who want to capture a broader perspective of price movements within a particular period. Bar charts can aid in spotting trends, potential reversals, and key support and resistance levels.

Candlestick charts are often favored for their visual appeal and depth of information. Each candlestick provides the same data as a bar chart but in a more approachable format. Candlesticks are formed by a body that indicates the difference between opening and closing prices and wicks that show the high and low prices. Traders often use candlestick patterns to anticipate future market movements, making them a powerful tool for both technical analysis and trading strategy development. The wealth of information presented in candlestick charts helps traders make informed decisions based on price action.

Price Action Basics

Price action refers to the movement of a security’s price over time. This approach is pivotal for traders seeking to make informed decisions based on market behavior without relying heavily on indicators or complex analytical systems. By understanding price action, traders can effectively interpret and react to market dynamics, making it essential for anyone looking to excel in forex trading.

Reading price movements involves analyzing charts to grasp how prices change in relation to time. Forex charts often display price movements in candlestick format, where each candlestick represents a specific time frame. Traders should pay attention to the open, high, low, and close points of these candles. The formation of various candle patterns can indicate shifts in market sentiment. For instance, a series of bullish candles signals increasing buyer confidence, while bearish patterns may indicate seller dominance.

Identifying trends is a fundamental aspect of price action analysis. A trend is generally categorized as bullish (upward), bearish (downward), or sideways (ranging). These trends can be signaled by the highs and lows of price movements, where higher highs and higher lows suggest a bullish trend, while lower highs and lower lows indicate a bearish trend. Recognizing these patterns is crucial for predicting potential future price changes, as trends often continue within the same direction before experiencing reversals.

Additionally, understanding market sentiment through price action is invaluable. Price movements can reflect the collective psychology of market participants, revealing whether traders are predominantly optimistic or pessimistic regarding currency fluctuations. By interpreting these movements, traders can gain insights into potential future behavior, enabling them to formulate strategies that align with prevailing market conditions.

Common Chart Patterns

In the world of Forex trading, understanding chart patterns is essential for making informed decisions. These patterns serve as visual indicators of potential future price movements and can help traders decide when to enter or exit trades. Among the most recognized chart patterns are the head and shoulders, triangles, and double tops and bottoms. Each of these patterns has unique characteristics and implications for traders.

The head and shoulders pattern is one of the most definitive reversal patterns. It appears as three peaks: a higher peak (the head) between two lower peaks (the shoulders). An inverse head and shoulders pattern can indicate a potential bullish trend reversal. To identify this pattern, traders look for a price movement that breaks the neckline after the formation of the shoulders. By confirming the pattern, traders can strategize their entry point for maximum profitability.

Triangles are another significant category of chart patterns, which come in three forms: ascending, descending, and symmetrical. These patterns occur when the price is making lower highs and higher lows, indicating a period of consolidation. The breakout from a triangle pattern usually predicates a strong price movement in the direction of the breakout. By tracking the breakout and subsequent volume, traders can make informed decisions about their positions.

Double tops and bottoms signify potential reversals in trend direction. A double top occurs when the price peaks twice at approximately the same level, suggesting resistance, while a double bottom indicates support after failing to break lower twice. Both patterns alert traders to possible trend changes, helping them refine their trading strategies. Identifying these patterns early can result in maximizing profits and minimizing losses in the volatile Forex market.

Support and Resistance Levels

Understanding support and resistance levels is crucial for any trader engaging in the forex market. These concepts serve as fundamental indicators that can signal potential price movements. Support levels indicate a price point where an asset tends to stop falling and may even reverse, while resistance levels denote a pricing ceiling where the asset struggles to rise further. Identifying these levels on forex charts allows traders to make informed decisions based on historical price behavior.

To pinpoint support and resistance levels, traders often examine recent price movements on charts. A support level is typically formed when the price has declined to a certain point and has bounced back multiple times, suggesting strong buying interest at that level. Conversely, a resistance level can be determined by observing where the price peaks multiple times before pulling back, indicating that selling pressure is dominant at that specific level. Key techniques for identifying these levels include using horizontal lines, trend lines, and Fibonacci retracement levels.

The psychological impact of these levels on traders cannot be understated. Many market participants base their trades on these significant price points, which reinforces their importance. For instance, approaching a support level may prompt traders to buy, believing that prices will not dip below this level. Similarly, near a resistance level, traders may decide to sell, anticipating a reversal. Hence, recognizing and effectively utilizing support and resistance levels can lead to more strategic trading decisions and a greater understanding of market trends.

To optimize trading strategies, traders should integrate support and resistance levels with other technical indicators, such as moving averages and RSI (Relative Strength Index). This holistic approach not only enhances trading effectiveness but also improves overall market analysis, providing traders with a clearer picture of potential price movements.

Utilizing Indicators in Forex Trading

In the realm of Forex trading, the use of technical indicators is paramount as they aid traders in making informed decisions based on market trends and price movements. Among various indicators, moving averages and the relative strength index (RSI) stand out due to their effectiveness in enhancing trading strategies.

Moving averages serve as a statistical tool that smooths out price data by creating a constantly updated average price. This indicator helps in identifying the direction of the trend over specific time frames, making it invaluable for traders who wish to determine entry and exit points. The two most common types of moving averages are the simple moving average (SMA) and the exponential moving average (EMA). While the SMA calculates the average price over a specified period, the EMA gives more weight to recent prices, making it more responsive to market changes. Traders often use moving averages to spot crossover points, where a short-term moving average crosses above or below a long-term moving average, signaling potential buy or sell opportunities.

On the other hand, the relative strength index (RSI) is a momentum oscillator that measures the speed and change of price movements. Ranging from 0 to 100, the RSI is primarily used to identify overbought or oversold conditions in the market. A reading above 70 typically indicates an overbought condition, suggesting a potential downward reversal, while a reading below 30 suggests an oversold condition, indicating a possible upward bounce. RSI is particularly effective in trending markets and can be used alongside other indicators to confirm trade signals, thus enhancing the accuracy of entries and exits.

Integrating these indicators into your trading routine can provide deeper insights into market conditions, allowing for well-informed decisions that align with your trading goals.

Combining Chart Analysis with Fundamental Analysis

In the realm of Forex trading, successful traders often integrate both chart analysis and fundamental analysis to enhance their trading strategies. Chart analysis allows traders to observe historical price movements through different types of charts, such as line, bar, or candlestick charts. These visual representations of price action provide essential insights into market trends, support and resistance levels, and potential entry and exit points. However, the effectiveness of technical analysis can be significantly bolstered when combined with fundamental analysis.

Fundamental analysis involves evaluating economic, financial, and geopolitical factors that can impact currency values. Economic indicators, such as interest rates, employment figures, and GDP growth, play a crucial role in shaping market sentiment. By staying updated on relevant economic news and market events, traders can better understand the broader context in which price movements occur. For instance, an unexpected increase in a nation’s interest rates may lead to a surge in its currency’s value. By integrating this knowledge into their chart analysis, traders can make more informed predictions about potential price movements.

To effectively combine both analyses, traders should establish a routine that includes monitoring economic calendars for upcoming news releases and regularly reviewing key indicators that affect their trading pairs. Simultaneously, they should analyze charts to identify patterns and trends that align with these fundamental insights. It is important to remain adaptable and recognize that market reactions to news can vary. While chart patterns may suggest a certain direction, understanding underlying economic dynamics can offer valuable context for making trading decisions. This holistic approach helps traders navigate the complexities of the Forex market more effectively, thus improving their potential for successful trades.

Developing a Trading Strategy Based on Chart Analysis

To successfully navigate the Forex market, developing a robust trading strategy that incorporates chart analysis is imperative. A comprehensive approach should involve a clear understanding of entry and exit points, effective risk management, and the ability to adapt strategies according to prevailing market conditions. Start by analyzing Forex charts to identify trends, support and resistance levels, and potential reversal points. These elements are crucial for making informed trading decisions.

Setting entry points requires careful consideration of various indicators derived from chart analysis. For instance, if a trader notices a bullish pattern forming, it may indicate an opportune moment to enter a trade. Conversely, identifying clear exit points is equally important. Traders should establish take-profit and stop-loss levels based on technical indicators and personal risk tolerance. Utilizing chart patterns, such as head and shoulders or double tops, can significantly assist in determining these critical price levels.

Risk management is another essential aspect of an effective trading strategy. Investors should aim to risk only a small percentage of their capital on a single trade to preserve their investment over the long term. This approach helps maintain a favorable risk-reward ratio. Additionally, traders should regularly reassess their strategy in light of changing market dynamics. The Forex market is known for its volatility, and as such, it is vital to remain adaptable. This may involve modifying entry and exit points or reallocating resources to more promising currency pairs based on ongoing chart analysis.

In conclusion, implementing a trading strategy founded on thorough chart analysis, coupled with disciplined risk management and adaptability, increases the likelihood of trading success in the Forex market. By remaining vigilant and responsive to market changes, traders can effectively enhance their overall performance.

Conclusion: Mastering Forex Charts for Trading Success

In the dynamic world of forex trading, the ability to read and analyze forex charts effectively is paramount for achieving success. Through our examination of various chart types, indicators, and patterns, it is evident that a solid understanding of these elements enhances a trader’s ability to make informed decisions. Forex charts are not merely tools for visualization; they present a wealth of information that can guide traders in identifying trends and potential market reversals.

One of the key takeaways from this article is the importance of familiarizing oneself with different types of charts, such as line, bar, and candlestick charts. Each chart offers unique insights into price movements and market sentiment. Understanding these differences enables traders to select the most suitable chart type for their trading style, whether they prefer short-term scalping or long-term investing.

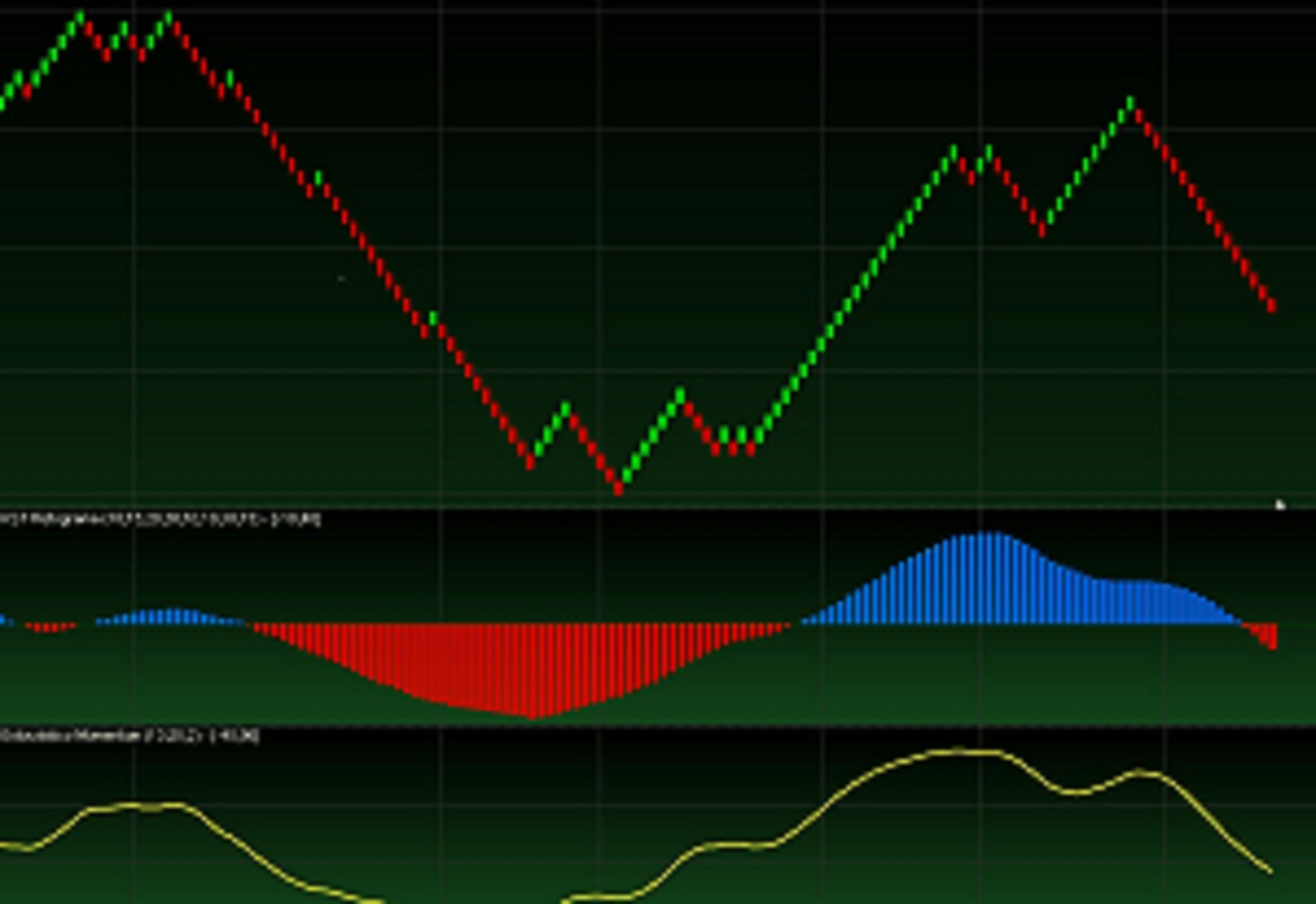

Moreover, technical indicators play a crucial role in the analysis of forex charts. Indicators such as moving averages, Relative Strength Index (RSI), and MACD assist traders in discerning market trends and gauging momentum. Integrating these indicators into regular analysis can significantly increase the likelihood of making profitable trades. Continuous practice and evaluation of trading strategies in conjunction with these analytical tools are essential for refining one’s skills.

The journey to mastering forex charts is not a solitary endeavor. Engaging with educational resources, participating in trading forums, and even consulting experienced traders can provide valuable insights and enhance one’s understanding. As markets evolve, traders must remain adaptable and keep honing their chart-reading capabilities. Ultimately, success in forex trading hinges on the mastery of forex charts, enabling traders to navigate the complexities of the forex market confidently.

hello